Have you noticed how financial teams are under more pressure than ever to deliver faster and more accurate analysis? In today’s competitive environment, lenders, analysts, and investors need immediate access to reliable numbers to make informed decisions. That is where AI-driven financial spreading has emerged as a game changer. This blog explores how artificial intelligence transforms financial data extracted, reconciled, analyzed, and presented in 2025. We will examine its impact on lending, investment banking, and financial modeling while exploring the AI features that make these advancements possible.

The New Era of Automated Financial Spreading

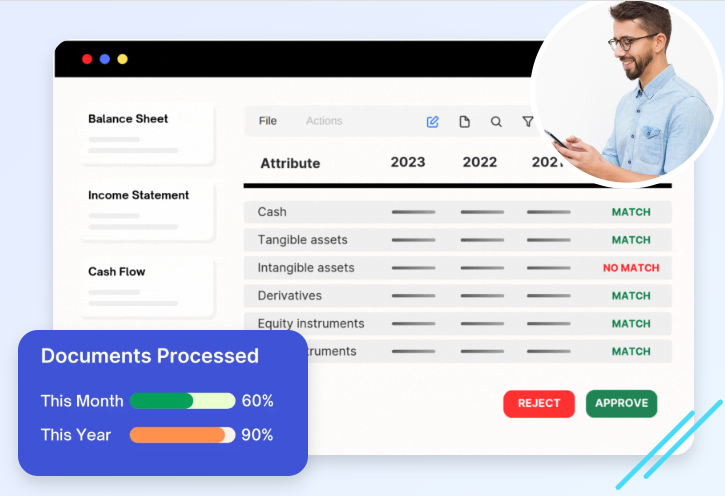

Traditional financial spreading is time-consuming and prone to human error. Analysts manually extract data from balance sheets, income statements, and cash flow reports, then reformat it into standardized templates. With AI, this process is automated, allowing faster turnaround without sacrificing accuracy. AI-powered Financial Spreading platforms can capture information from dense tables, multi-column layouts, and charts, classifying it into the correct categories for seamless analysis. Multi-language capabilities allow global teams to process reports from multiple regions without translation delays.

How AI Improves Accuracy and Consistency

The integrated validation engine of AI in financial spreading is one of its best features. It checks figures for consistency across all statements and related notes, ensuring nothing is out of alignment. This means the balance sheet ties to the income and cash flow statements without discrepancies. For lenders and investors, this level of reconciliation improves trust in the data and reduces the risk of making decisions based on flawed information. Normalizing data into standardized formats makes cross-company and multi-year comparisons much more efficient.

Streamlining Commercial Lending Decisions

In commercial lending, speed and accuracy are critical. AI-powered Financial Spreading tools evaluate creditworthiness by quickly analyzing liquidity ratios, solvency metrics, and historical performance trends. With automated ratio calculations, lenders can generate detailed risk profiles in minutes rather than hours. This shortens loan approval timelines and reduces the operational burden on credit analysts. The ability to reconcile and verify figures directly from

source documents provides added confidence in the assessment.

Transforming Equity Research and Investment Banking

Accurate and up-to-date information is non-negotiable for equity research analysts and investment bankers. AI-driven Financial Spreading solutions pull structured data from earnings statements, investor presentations, and annual reports and consolidate it into usable models. Analysts can then focus on interpreting the numbers rather than hunting for them. Trend analysis features reveal performance shifts, allowing investment professionals to identify opportunities or red flags sooner. This comprehensive view supports more confident buy, sell, or hold recommendations.

Enhancing Financial Modeling Capabilities

Financial modeling depends on clean, consistent data. With AI, Financial Spreading platforms feed models with validated inputs, eliminating the need for extensive data cleaning. The ability to score companies based on standardized metrics further enhances comparability across industries. This means financial models are built faster and grounded in data that has been rigorously checked for integrity. Whether forecasting revenue, estimating valuations, or stress testing scenarios, the output is more reliable and ready for strategic decision-making.

Advanced Document Intelligence Features

The foundation of AI-powered Financial Spreading lies in its document intelligence. These systems use advanced scanning to capture data from complex visual formats and semantic classification to determine whether figures belong to the balance sheet, income statement, cash flow statement, or notes. Extraction and mapping processes then transform raw data into structured templates. This is supported by high-accuracy algorithms that reduce misclassification and ensure numerical accuracy, making them a significant upgrade from manual entry methods.

Seamless Data Reconciliation Across Sources

Reconciliation is a critical step in Financial Spreading, and AI handles it precisely. It cross-verifies numbers between different reports to ensure internal consistency. For example, it checks that the figures in the notes match the main statements and that earnings reports align with investor presentation data. This process is vital for establishing credibility with stakeholders and maintaining compliance with reporting standards.

Operational Benefits Beyond Analysis

The benefits of AI-powered Financial Spreading extend beyond data processing. Centralized document management hubs allow teams to store, access, and organize all financial reports in one place.This speeds up retrieval and removes version control problems. Customer onboarding tools simplify adding and managing client data with transparency and control. Built-in analytics dashboards turn financial data into visual insights, making performance tracking intuitive and actionable for executives.

The Global Adoption Trend in 2025

As enterprises worldwide recognize the efficiency and accuracy gains, AI-driven Financial Spreading is becoming a standard practice rather than an emerging innovation. Banking, insurance, manufacturing, and technology companies are adopting these tools to improve decision-making and operational efficiency. By replacing manual processes with automated workflows, organizations free their teams to focus on higher-value tasks like strategic planning and market analysis.

Conclusion

The year 2025 marks a turning point in how organizations handle financial spreading. AI has shifted it from a labor-intensive, error-prone process to a streamlined, precise, and insight-rich function. Companies are able to decide more quickly and intelligently by integrating advanced document intelligence, automated reconciliation, trend analysis, and robust reporting. This transformation benefits lenders, investors, and corporate strategists, delivering operational efficiency and competitive advantage.

For those ready to modernize their financial processes, embracing AI-powered financial spreading is no longer optional. It is the key to staying ahead in a data-driven economy where speed, accuracy, and insight define success.